ABFP program renamed to BFP.

Eligible Project Costs

Support can be considered for needed planning activities plus capital and non-capital business investments.

Each individual IFI has their own lending criteria and process that may not align exactly with AIC BFP criteria listed below. A such, an IFI and AIC may have different criteria regarding timelines, business types, project activities and costs. For example, an IFI may have more discretion as to their lending in contrast to stricter criteria imposed by AIC's funder regarding non-repayable funding.

Planning

Applicants are encouraged to participate in as much of their own business/project planning as possible. There are circumstances when assistance, in the form of qualified professional services, is required in advance of making decisions and implementing a project. Planning costs may be considered if they will clearly support key business/project decisions, either by applicants, funders, lenders and/or regulators.

What types of planning activities can be supported?

Project Plans and Studies

Project Plans and Studies

Project Plans and Studies

Completion of all or part of a project plan such as developing business models & strategies, comprehensive business plans, market assessments and feasibility studies. Business Plans are expected to be completed in a timely manner not to exceed 12 months.

Financials

Project Plans and Studies

Project Plans and Studies

Completion of financial projections, historical financial statements or other financial related activities in support of project or business decisions.

Business Valuations

Project Plans and Studies

Business Valuations

Business valuations by a Chartered Business Valuator (CBV) in support of a business acquisition.

Asset Appraisals

Regulatory Compliance

Business Valuations

Appraisal to determine the fair market value of an asset.

Regulatory Compliance

Regulatory Compliance

Regulatory Compliance

Activities in support of regulatory compliance such as an environmental assessment.

Other

Regulatory Compliance

Regulatory Compliance

Other needed activities in support of project decisions such as legal, design, engineering, etc.

To be considered for support, these costs must be substantiated by quotes that detail the scope and timing of work to be performed. The service provider’s qualifications and experience must also be demonstrated. The costs must be reasonable relative to the size, scope and complexity of the project.

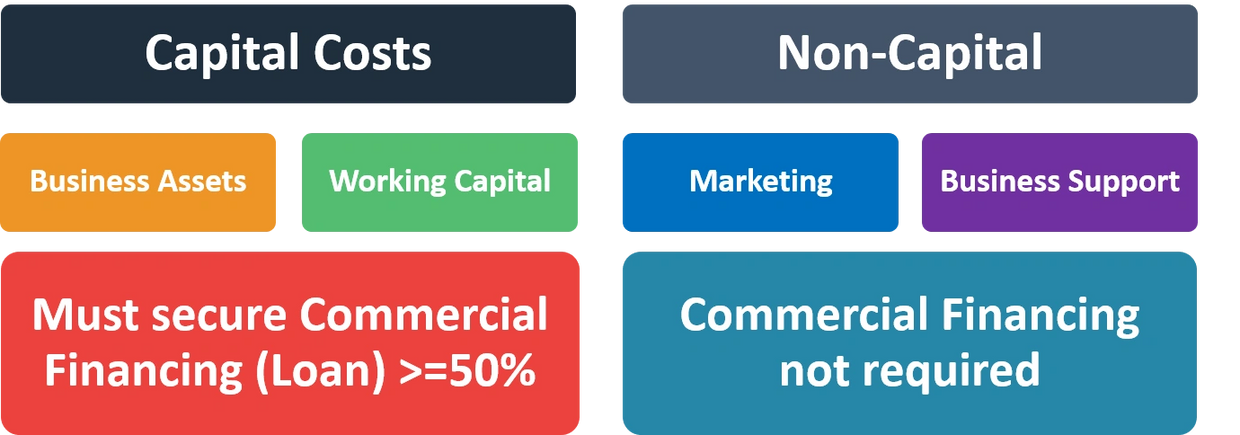

Business Investments

Support for capital and/or non-capital project costs may be considered. This could include the tangible assets used (Business Assets) and/or resources consumed (working capital for Operating Costs) in the production of goods or in the rendering of services of an eligible business activity. It could also include costs designed to enhance revenue growth (Marketing) and management capacity (Business Support).

Business investments enable results

Securing commercial financing of at least 50% of capital cost is required for 1st time clients/start-ups. Discuss commercial financing needs with your local IFI.

Initial Checklist

What types of business investments can be supported?

Business Assets

Business Assets

Business Assets

The tangible assets required to operate and deliver it products and services to customers, such as:

- Operating equipment and tools;

- Office equipment and furnishings;

- Computer equipment and software;

- Facility upgrades such as, leasehold improvements (where space is rented) or upgrades/renovations (where space is applicant-owned) for commercial use;

- All or part of the purchase price of acquiring an established business (confirmed by a valuation completed report by a Chartered Business Valuator);

- Franchise fees/rights; and,

- Specialized commercial vehicles (excludes passenger vehicles, cars and pickup trucks).

Physical assets supported by AIC must reside in Ontario.

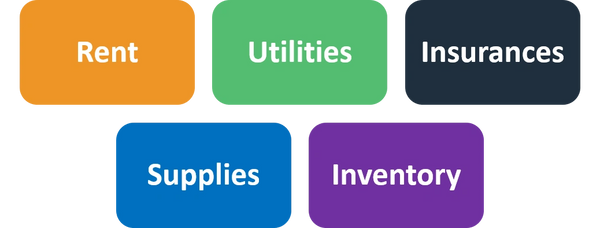

Working Capital

Business Assets

Business Assets

Normally for start-up businesses, initial operating costs supported by quotes/estimates, such as:

- Rent;

- utilities;

- fees related to eligible project costs;

- insurances;

- supplies; and,

- inventory.

Support for these costs is intended to ensure the business has sufficient working capital while a project is implemented. Normally three (3) months is considered reasonable. The actual amount supported will be based on the applicant’s financial projections and consultations with lenders or IFI to confirm the amount is appropriate. Applicants are also encourage to secure additional lines of credit.

There are circumstances where operating costs may be considered related to an expansion or activity where a clear financial need is demonstrated.

Owner wages and drawings cannot be considered under any circumstance. Operating salaries/wages are also not considered.

Marketing

Business Support

Business Support

Resources and activities required to market and promote a business while building the most effective and efficient channels that establish, maintain and grow relationships with customers and accelerate sales could be supported, such as:

- Design and branding;

- advertising (print, media, social-media, internet-based);

- printed materials;

- signage (billboards, storefronts, trade show banners, vehicle wraps)

- website and mobile application development;

- promotional items and branded clothing;

- customer relationship management systems;

- enhancements to point-of-sale (physical and online);

- sales training and expertise;

- promotional content (text, audio, video); and,

- networking and promotional events, and trade shows.

Business Support

Business Support

Business Support

Resources and activities that enhance the capabilities and capacity of management could be supported, such as those enabling:

- Sound business decisions;

- optimal business structures;

- enhanced efficiency and effectiveness of operations;

- expanding and improving existing (already commercialized) products and services;

- risk mitigation; and/or,

- compliance and reporting.

Common examples of these costs include accounting & bookkeeping, legal advisory, maintaining membership in a professional body or industry associations, specialized training and mentorship (knowledge transfer). Expertise to improve processes and/or products and project implementation activities could be considered where a clear need is demonstrated.

- To be considered for support, costs must be reasonable relative to the size, scope and complexity of the project. Cost that relate to activities or assets for personal consumption or not to generate active business income cannot be supported. Personal expenses, drawings, wages, or salaries for owners, staff, and/or related parties are not eligible costs.

- Controlled substances and alcohol are not eligible expenses under any circumstance.

- Travel-related costs such as meals & accommodations are normally not considered and transportation costs are not eligible unless explicitly approved in advance by AIC.

Read more

Click below to learn if your project type is eligible.

If you, your business, your project and type and cost appear to be eligible, contact your local IFI. If you are unsure who you should apply to please contact AIC.

Copyright © 2019-2025 Aboriginal Impact Capital