ABFP program renamed to BFP.

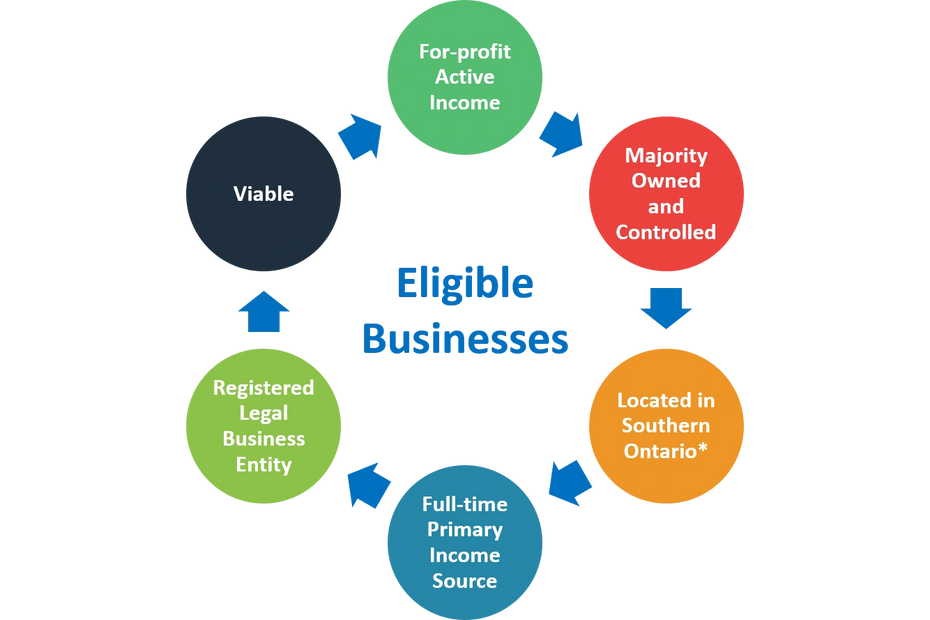

Eligible Businesses

Permanent, for-profit business entities operating in southern Ontario, owned and controlled by eligible applicants (at least 50% or higher if IFI requires) and generating active business income may be considered. Documentation regarding the legal business entity and business registrations are required. Viability of the business must also be clearly demonstrated. Applicant businesses must clearly meet all six (6) business eligibility requirements. Each individual IFI may have varying eligibility requirements related to their loans and BFP recommendations that may be not align exactly with some of the criteria below.

Each individual IFI has their own lending criteria and process that may not align exactly with AIC BFP criteria listed below. A such, an IFI and AIC may have different criteria regarding timelines, business types, project activities and costs. For example, an IFI may have more discretion as to their lending in contrast to stricter criteria imposed by AIC's funder regarding non-repayable funding.

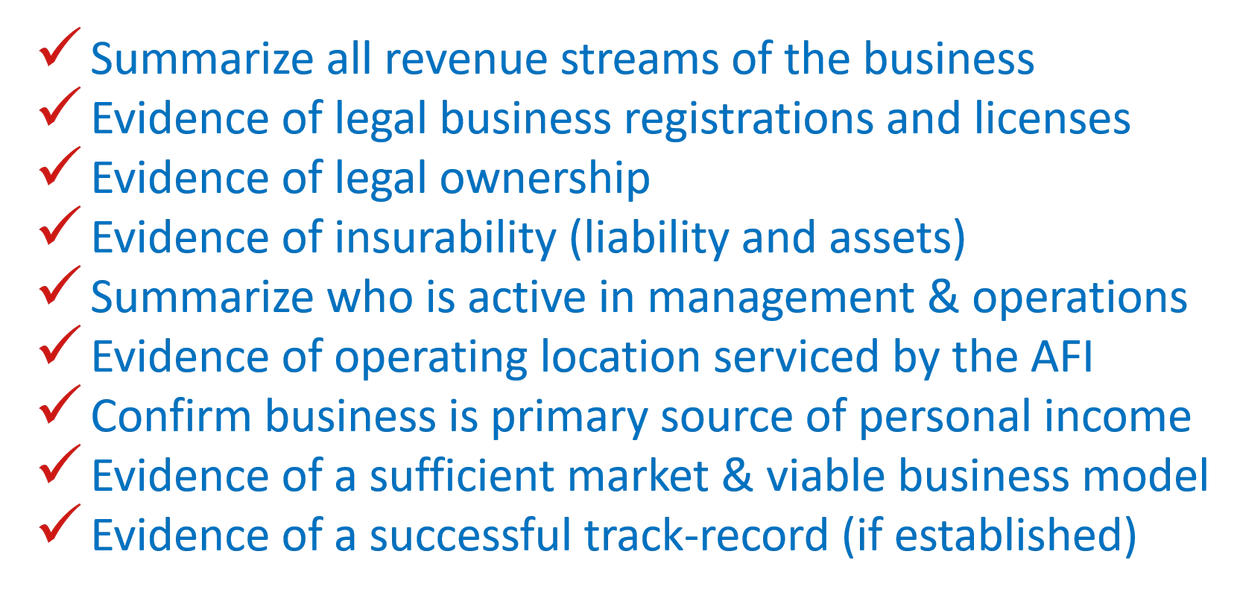

Initial Checklist

Read the details of business eligibility

For-profit Active Income

Majority Owned and Controlled

Majority Owned and Controlled

Only for-profit enterprises, generating active business income (not income from passive investments) may be considered.

Majority Owned and Controlled

Majority Owned and Controlled

Majority Owned and Controlled

The business must be at least 50% owned by eligible Indigenous applicants who are actively involved in the operations & essential to the successful management of the business.

Located in Southern Ontario*

Majority Owned and Controlled

Located in Southern Ontario*

The business must be physically located and operating in southern Ontario as serviced by our participating southern Ontario Aboriginal Financial Institution partners (* Note: FNAFO Agriculture has expanded service-delivery areas).

Full-time**

Registered Legal Business Entity**

Located in Southern Ontario*

The business must be intended to be the the full-time activity and primary source of income of eligible applicant(s).

Registered Legal Business Entity**

Registered Legal Business Entity**

Registered Legal Business Entity**

The business must be registered, licensed and certified as required in the industry and/or jurisdiction(s) in which the business will operate.

Viable**

Ultimately, only businesses with a clearly viable business model can be supported. This includes a sufficient market and a viable (profitable and sustainable business model).

Those having secured commercial financing from their local Indigenous Financial Institution (IFI) for their project will be considered by AIC to demonstrate financially viability.

Businesses with a track-record of profitability, as demonstrated by their financial statements, are more likely to be considered viable than new businesses without a track-record.

New business that demonstrate how they will replicate and maintain successful business models to similar types of businesses could be considered viable.

The most difficult businesses to demonstrate viability are those built around new and unproven products and services and/or those being established by inexperience owners.

Some highly regulated industries may not be considered for support as their risk may be above the risk-tolerance level of lenders and funders. Check with your local IFI.

** Where eligible applicants have secured financing from a participating local IFI, AIC may, at its full discretion, defer to the IFI's policies regarding full-time businesses, types of business registrations and business viability subject to BFP constraints.

Eligible business but not owned 100%

Businesses that are otherwise eligible (meet all the above criteria) but are not owned 100% by eligible Indigenous applicants may still be considered for support but pro-rated based on eligible ownership.

For example, if eligible applicants own 60% of the business, then the maximum support considered for capital costs would be 24% (60% * 40%) the maximum for planning and non-capital costs would be 45% (60% * 75%).

Pro-rated support

Non-Indigenous spouse

Non-Indigenous partners or shareholders

Non-Indigenous partners or shareholders

Eligible businesses co-owned with spouses where only one spouse is an eligible applicant will see support pro-rated at one-half (50%) regardless if the eligible applicant legally owns a percentage higher than 50%. If the ineligible spouse legally owns more than 50% or the eligible spouse is not substantially involved in the business (in the opinion of the local IFI and/or AIC) then the business may not be considered for BFP support.

Non-Indigenous partners or shareholders

Non-Indigenous partners or shareholders

Non-Indigenous partners or shareholders

Eligible businesses that are co-owned with non-Indigenous partners will see rates of support pro-rated by the percentage ownership of eligible applicant(s) as shown in the partnership or incorporation documents. The local IFI will determine if they consider the eligible Indigenous ownership adequate. If the ownership of eligible applicant(s) is less than 50%, the business may not be considered for BFP support.

Types of businesses & activities not supported

Businesses that are structured primarily for the benefit of ineligible persons will not be considered.

Businesses that generate income primarily from passive investments (financial investment and rental income), home-based tiered-marketing, not-for-profit activities and social-enterprises are not supported.

Also, activities that are highly regulated (for example, tobacco, gambling, production of alcohol, etc.) or whose appropriateness or legality is complex and/or not clear will not be considered for support. As of April 1, 2025, business related to cannabis are not eligible under our funder (NACCA) revised program guidelines.

Individual artistic endeavors (for example, writing a book, making a movie, recording a CD) or an single product are not considered permanent businesses and are not eligible and are not considered for support.

Business built around new and unproven products and services and/or those being established by inexperience owners are unlikely to be supported until they can demonstrate viability.

The program is also not intended to fund part-time or sideline businesses. Full-time seasonal business may be considered. The local IFI will ultimately decide these issues.

Read more

Click below to learn the eligibility criteria for entrepreneurs.

Click below to learn if your project type is eligible.

Copyright © 2019-2025 Aboriginal Impact Capital